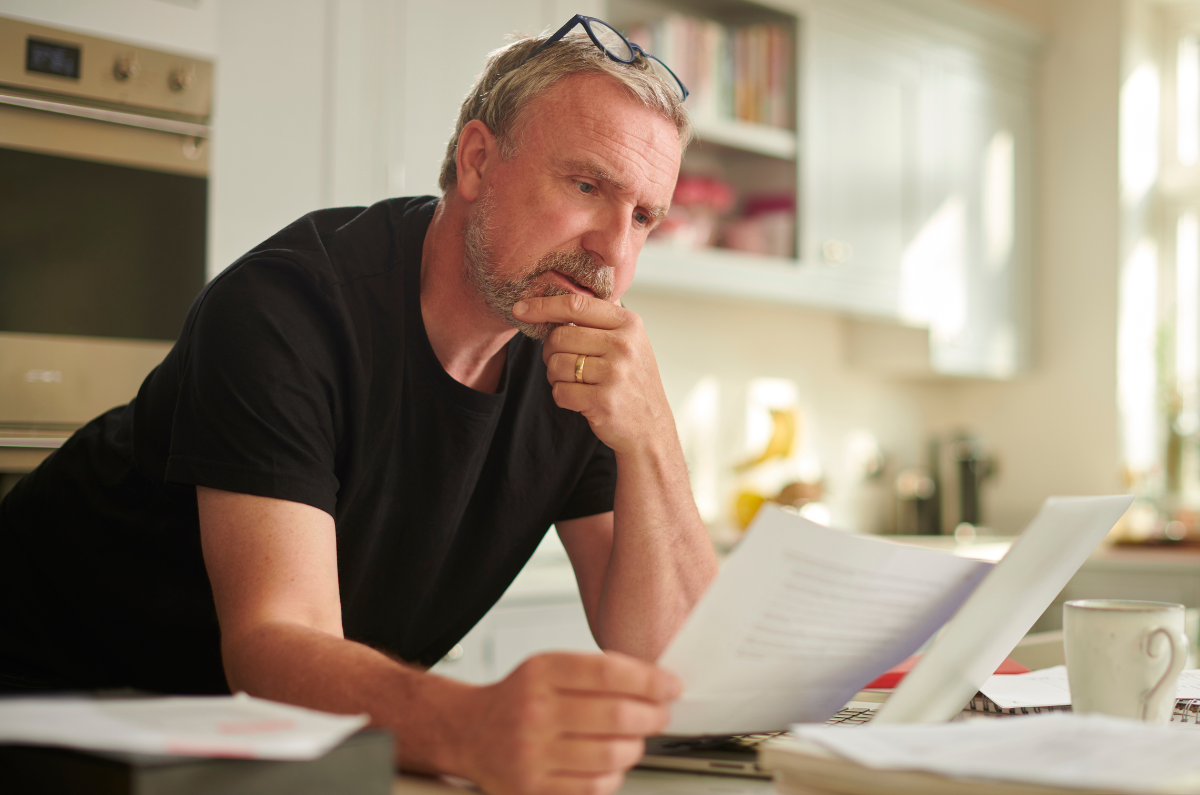

Living with a chronic musculoskeletal condition costs us physically, mentally and emotionally. But what many people don’t understand are the substantial financial costs associated with having chronic conditions. They’re expensive.

Healthcare costs

These are the most obvious. Medications, lots of trips to your doctor, your specialist/s, allied health professionals, tests, exercise classes, surgery, orthotics….they all add up. A lot!

People who don’t have a chronic condition may assume that a lot of this is covered by government subsidies, GP Management Plans, health insurance, the Pharmaceutical Benefits Scheme, with a little sprinkling of magical fairy dust to cover the rest. Depending on a person’s situation some of this may be covered. But much isn’t.

There’s significant cost in seeing allied health professionals such as physiotherapists, podiatrists, occupational therapists, hand therapists, dietitians and psychologists. While GP Management Plans assist with the cost, there’s mostly only five visits provided and these are used up very quickly. There may also be a gap payment over the Medicare Rebate. And there are also often considerable out of pocket expenses to see a specialist privately or longer waits when you see them publicly.

This can put a significant strain on a person’s finances.

Employment

Living with a chronic musculoskeletal condition is varied and episodic. That means you often don’t know how you’ll wake up. Your pain and stiffness may have been under control and manageable for some time, but then one day you wake up feeling crap. Your joints are swollen, it hurts to move, and you’re soooo exhausted. This makes it difficult to get up and move around, let alone get to work and put in a full day, as well as all the other things you have going on – family, friends, studying, chores, and a social life.

This may lead to time off work, and using up all your sick and personal leave. But if the situation (or workplace) becomes unmanageable it may result in someone having to permanently reduce their hours, change jobs, become unemployed or retire early.

Any of these things will obviously affect your everyday finances. However it can also affect your future finances as superannuation is impacted by reduced or lost income.

Wow. This became really depressing really quickly.

The good news is there are services to help you if you need to change careers, or need financial assistance while you re-evaluate what you can or can’t do. We’ve added a bunch of these to the More to Explore section below.

And while we know none of these services are perfect, they can provide you with many of the tools and resources to help you through this tough time.

Hidden costs

Lost employment and medical costs – check. They’re probably the most visible costs. But there are many hidden costs. We’ve listed just a few.

- Home and car modifications – so that you can continue to do the things you want and need to do as easily and pain-free as possible you may need to make changes to your home and/or car. They may be simple and relatively inexpensive – e.g. adding a swivel seat to your car to help you get in and out, or more complicated and pricey – e.g. installing a chair lift to help you get up and down the stairs in your home. An occupational therapist can help you work out what modifications will assist you, and can also advise you of any available schemes or assistance programs you may be eligible for.

- As well as changes to your home or car, you may also need to buy various gizmos and gadgets that: protect your joints (e.g. tap turners, pick-up reachers), help you manage your pain (e.g. heat packs) and generally make life a little easier (e.g ergonomic mouse for your computer, walking aids). Again these can range in price.

- Getting out and about if you’re in pain, or dealing with serious brain fog, can be tricky if you don’t feel up to driving. It was only made worse with the COVID pandemic, when many of us felt vulnerable catching public transport. So you may have resorted to catching a taxi or using a rideshare company. But over time this does add up. You may be eligible for a taxi subsidy – each state/territory has their own scheme – so it’s worth checking to see if you can access this.

- Food, glorious food. Let’s face it there are many times you feel flattened by your condition and cooking is the last thing you want to do. And now with the convenience of delivery apps, you can get almost anything delivered to your door. Unless like me you live in an outer suburb in which case it’s fish n’ chips, pizza or burgers – yum, but not the healthiest options. These deliveries can be a lifesaver, but the cost can also very quickly add up.

- Events and holidays. This’s a tough one. Because of the nature of chronic conditions and often not knowing how you’ll feel from day to day, you can pay for future events and then have to cancel or change at the last minute. Like tickets to a concert – you often buy them so far in advance and you’re excited for literally months! And then the night comes and you know you can’t go – you’re too tired, too sore, too whatever. So you have to forfeit your ticket, or give it away to a friend. Or you’re on holiday, but you end up having to pay to make changes because you’ve had a flare and you need an earlier flight home, or you need to catch more taxis than you’d planned to, or you need to buy a pillow because the one at your hotel is a rock. It’s the crazy, unpredictable stuff like this that’s hard to plan for and adds to financial stress.

Contact our free national Help Line

If you have questions about your musculoskeletal condition, treatment options, telehealth, managing your pain or accessing services be sure to call our nurses. They’re available Monday to Thursday between 9am-5pm on 1800 263 265; email (helpline@msk.org.au) or via Messenger.

More to explore

- Access for People with Disability

Australian Government, JobAccess

This site helps people with disability find and keep jobs, get promoted to better jobs, upgrade or expand their workplace skills, and more. - Best practice guide: The right to request flexible working arrangements

FairWork Ombudsman - Career Transition Assistance

Australian Government, jobactive

Designed to help mature-age job seekers to build their confidence and skills to become more competitive in their local labour market. - Centrelink Entitlements

Chronic Illness Alliance - Eight tips for looking after your mental health through unemployment

Beyond Blue - Employment Assistance Fund

Australian Government, JobAccess - Government Assistance

Pain Australia - Job in Jeopardy Assistance

Australian Government, Services Australia - Making the right financial moves during the COVID-19 coronavirus outbreak

Choice, 7 April 2020 - Payments for people living with an illness, injury or disability

Australian Government, Services Australia - Types of care

Australian Government, My Aged Care

This is a federal government scheme for older Australians needing assistance to live independently in their own homes. You can get assistance with everyday tasks and home modifications. - Your guide to Australian careers

Australian Government, Job Outlook

This site helps you make decisions about study and training, your first job, or the next step in your career. Includes physical and other demands of jobs.